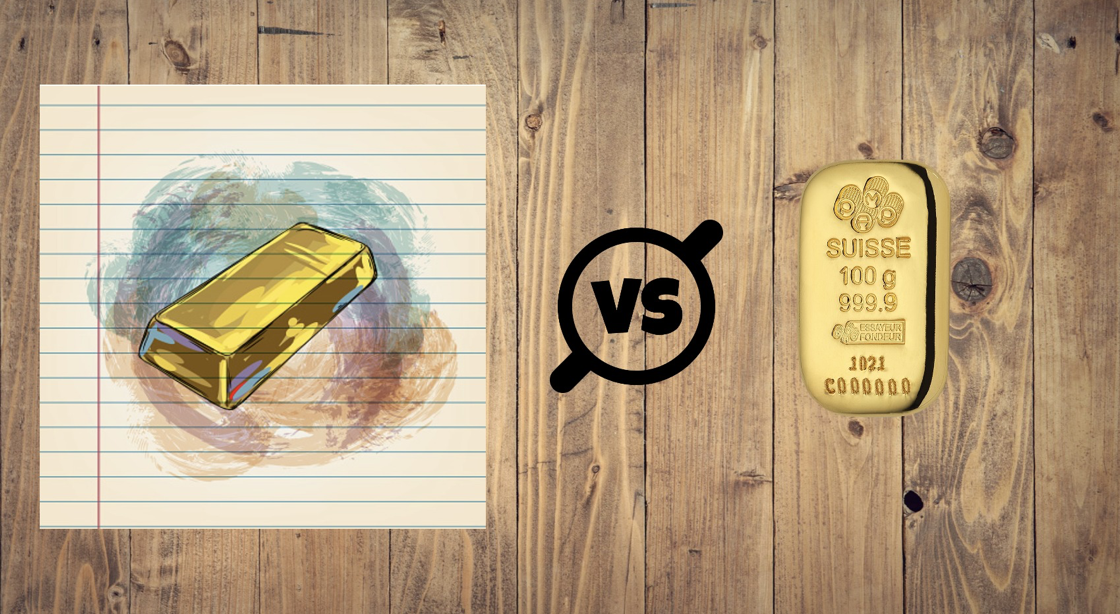

While physical gold and silver have a tangible presence, there are also paper-based investment alternatives. Understanding the differences between physical and paper gold/silver investments is crucial for those of us seeking to make informed decisions in the precious metals market.

Physical gold and silver investments involve the purchase and ownership of tangible bullion in the form of coins, bars, or jewelry. These investments offer several distinct advantages:

- Tangible Ownership: Physical gold and silver provide investors with direct ownership and possession of the precious metals. Holding physical assets allows for a sense of security and control over one’s investment.

- Intrinsic Value: Physical gold and silver have intrinsic value based on their rarity, demand, and industrial applications. The value of physical bullion is derived from the precious metals themselves, making it less susceptible to counterparty risks.

- Portfolio Diversification: Physical gold and silver are often considered safe-haven assets that can act as a hedge against inflation, economic uncertainties, or currency devaluations. Adding physical bullion to an investment portfolio can provide diversification and reduce overall risk.

Paper Gold/Silver Investments:

Paper gold and silver investments, also known as synthetic or derivative investments, represent ownership or exposure to the precious metals through financial instruments, such as exchange-traded funds (ETFs), futures contracts, or certificates. Here are key features of paper-based investments:

- Convenience and Accessibility: Paper gold/silver investments offer convenience and ease of trading through various financial markets. Investors can buy or sell these instruments electronically, often without the need for physical delivery or storage.

- Liquidity and Flexibility: Paper gold/silver investments provide liquidity as they can be easily bought or sold in the financial markets. These investments offer flexibility in terms of trading size and enable investors to take advantage of short-term price movements.

- Counterparty Risk: Unlike physical investments, paper gold/silver exposes investors to counterparty risk. These instruments rely on the financial stability and integrity of the issuing institution or counterparty. In case of insolvency or default, investors may face challenges in realizing the full value of their investment.

- Potential Lack of Transparency: Paper gold/silver investments may lack transparency regarding the actual physical holdings backing the instrument. Investors must carefully assess the credibility and transparency of the issuer to ensure the investment accurately represents the underlying precious metals.

Considerations for Investors:

When considering physical or paper gold/silver investments, investors should evaluate their individual investment goals, risk tolerance, and preferences. Here are some key considerations:

- Risk vs. Convenience: Physical investments offer tangible ownership and inherent value but require storage and security arrangements. Paper investments provide convenience but expose investors to counterparty risk.

- Price Discrepancies: Prices for physical gold/silver may differ from paper-based instruments due to factors such as premiums, storage costs, and supply/demand dynamics. Investors should compare prices and understand the factors influencing each market.

- Investment Horizon: Physical investments are well-suited for long-term holders and those seeking wealth preservation. Paper investments may be more suitable for traders or those with short-term investment goals.

- Combination Approach: Investors can adopt a balanced approach by diversifying their portfolio with a mix of physical and paper gold/silver investments, leveraging the unique advantages of each.

Understanding the differences between physical gold/silver and paper gold/silver investments is essential for those of us looking to enter the precious metals market. While physical investments offer tangible ownership, intrinsic value, and portfolio diversification, paper investments provide convenience, liquidity, and flexibility. Assessing each of our investment goals, risk appetite, and market dynamics can help us decide which is more suitable for us.

#papergold #papersilver #derivatives #preciousmetals #physicalsilver #physicalgold