Continuing where we left off from the last chapter, the war saw many countries printing massive amounts of new money into the economy that did not correspond to an increase in their gold holdings. This led to a hyper-inflationary period where governments fell into heavy debt which could not be repaid.

During this period, many countries tried to partially re-adopt the gold standard by including U.S. dollars and British pounds in their reserve holdings together with gold. These 2 currencies were chosen as they had the most stable exchange rate with gold. This was known as the gold exchange standard.

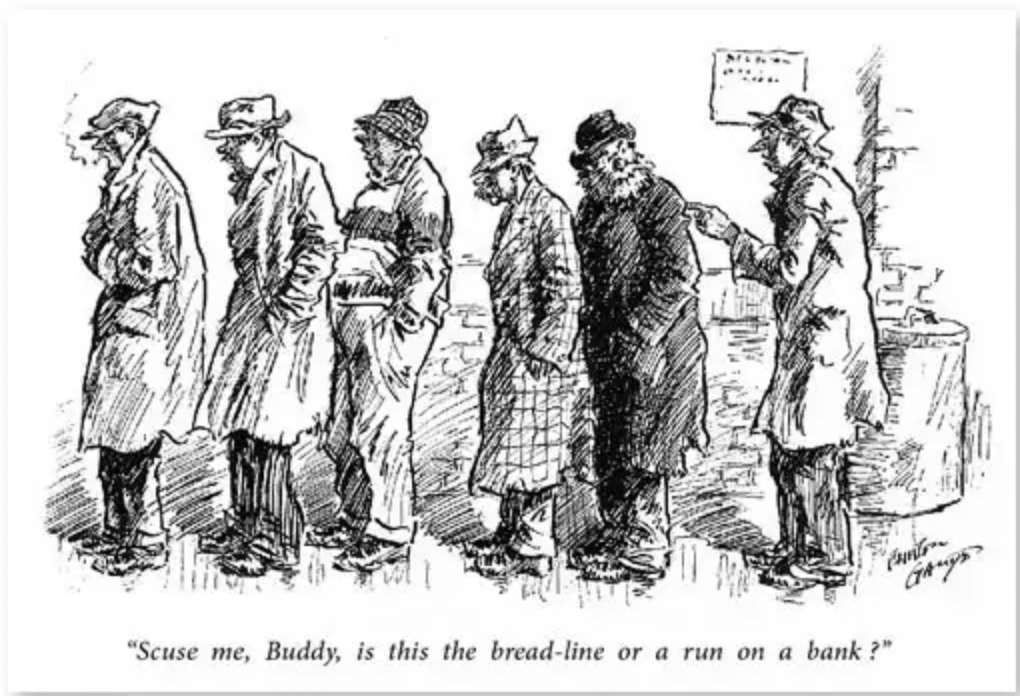

However, the Great Depression was the final nail in the coffin for the gold exchange standard. When the stock market crashed in 1929, many European countries had exchange rates that were not reflective of their true holdings in reserve. This led bank runs and gold hoarding in many a country as peoples’ distrust in the paper money grew.

To combat the bank runs, governments started raising interest rates in hope that people would keep their money in the bank for better returns. But that only raised the cost of doing business, which led to many businesses going under, hence yet more unemployment.

Britain eventually succumbed and left the gold exchange standard in 1931 after facing huge capital and gold outflows. Many countries followed suit as their situations worsened, and soon only the United States and France were left on the gold exchange standard.

The United States, then under President Roosevelt, nationalised the private citizens’ gold and made redundant contracts specifying payment in gold. All gold in the country was supposedly to be turned in to the Federal Reserve and held at Fort Knox. The United States then used dollars to pay down their debt instead of gold, essentially cornering the global gold market.

In the final part of this series, we will look at the Bretton Woods system and its failure leading up to our current system.

Sources: britannica.com, econlib.org, focus-economics.com#goldstandard#gold#brettonwoods#goldhistory